Critical Raw Materials

The „one-size-fits-all“ approach for self-sufficiency through the Critical Raw Materials Act (CRMA) is idealistic, because different market conditions apply to each strategic raw material, and resources and potential vary for each individual raw material. The existing platinum group metals (PGMs) recycling industry gives end-users and those developing new green technologies reassurance as to the long-term sustainability and security of PGMs availability while fears for potential resource depletion are misplaced.

According to industry experts and market analysts, the increased demand will stimulate thrifting of metal in applications (reducing the amount of PGMs used in applications) which will also contribute to ensure sufficient availability. Furthermore, the growing demand will also increase investment in mining processes that are based on circular principles and seek to minimise, reuse, and ultimately eliminate waste.

The CRMA must also include a much stronger global strategy for securing responsible imports. In the case of PGMs, even a very ambitious recycling strategy of these CRMs will not completely lead to substitution of demand for supply from primary production.

As the EU will remain reliant on imports to supply its medium-term growth in the next 15 years, IPA recommends that the EU increases its ambitions to secure responsible and fair imports from prioritised resource-rich partners.

Circularity in usage

The PGM industry is strongly committed to the circularity in the usage of these metals. We support plans to make Europe the global leader for high-quality metals recycling as recycling will be Europe’s key long-term opportunity to establish metals strategic autonomy, especially after 2040 when the first generation of clean energy technologies reaches end-of-life in significant volumes.

The PGM industry understands the need to secure long-term critical raw materials to enable the clean energy transition. However, with regard to safeguarding supply of iridium, experts from the PGM industry believe that any attempt to procure large iridium volumes could lead to irrational price moves that would impact the electrolysis market.

Future availability

Research undertaken by industry players suggests that with appropriate management, notably through thrifting and recycling, there will be enough iridium and platinum available to allow PEM electrolysis and PEM fuel cells to scale up to the necessary levels to make a major contribution to the energy transition. Please find more information in the IPA White-Paper on Iridium.

Also with the potential reduction of sales of internal combustion engine vehicles, more PGMs will become available for various other drivetrain applications in vehicles such as fuel cells. However, a prerequisite for a comprehensive recycling of CRMs from end-of-life vehicles is a better control of leakage of waste outside of Europe to address the massive volumes of illegally exported and other unreported end-of-life vehicles.

Why are PGMs critical raw materials?

PGMs feature on the European Union list of materials „at risk“ (Critical Raw Materials“) largely because of the geographically concentrated supply from regions outside the EU (South Africa and Russia). The main focus of the Critical Raw Materials methodology lies on supply risk and economic importance, not on physical scarcity or on oversupply.

What are Critical Raw Materials?

Raw materials are fundamental to Europe's economy, and they are essential for maintaining and improving our quality of life. Recent years have seen a rapid growth in the number of materials used across products. Securing reliable and undistorted access of certain raw materials is of growing concern within the EU and across the globe. Critical raw materials have a high economic importance to the EU combined with a high risk associated with their supply. They are the most important materials in terms of competitiveness of the European industry due to their unique properties.

Are PGMs really a Critical Raw Material?Huge efforts of research and development in academic and industrial research laboratories have been directed towards the development of innovative material solutions that can reduce the use of PGMs in high-tech applications. Currently, only the strategies of Reduction and Recycling have the potential to mitigate the risks resulting from the primary production concentration outside the EU. The potential of the strategy Substitution, however, can be considered extremely slight.

Substitution

Substitution of PGMs is part of the EU‘s Raw Materials Strategy to reduce the use of these precious metals as critical raw materials. Substitution needs to be considered carefully on a case-by-case basis and also targeted appropriately towards selected applications. For some applications it may be possible to reduce the use of a particular material (know as thrifting) or to replace it completely. However, the use of a particular critical material can confer exceptional performance that may justify the associated supply risks and additional costs incurred.

In two applications with a high reliance on PGMs, catalytic converters and fuel cells, industrial end-users tried to reduce and minimise the use of platinum due to the high relative price of the metal. With regard to automotive emission control catalysts, the findings of several years of research and substantial investments from industry as well as from the public sector over the course of the past 50 years made it clear that PGMs can currently not be substituted without a loss of performance and increased cost. The current technology, a heterogeneous catalytic function containing PGMs based upon a monolithic substrate body, has proven it's robustness with practically no recalls over the whole period of mass serial application.

In some cases, a platinum group metal can be replaced by another PGM, e.g. platinum in some types of catalysts can be replaced by palladium.

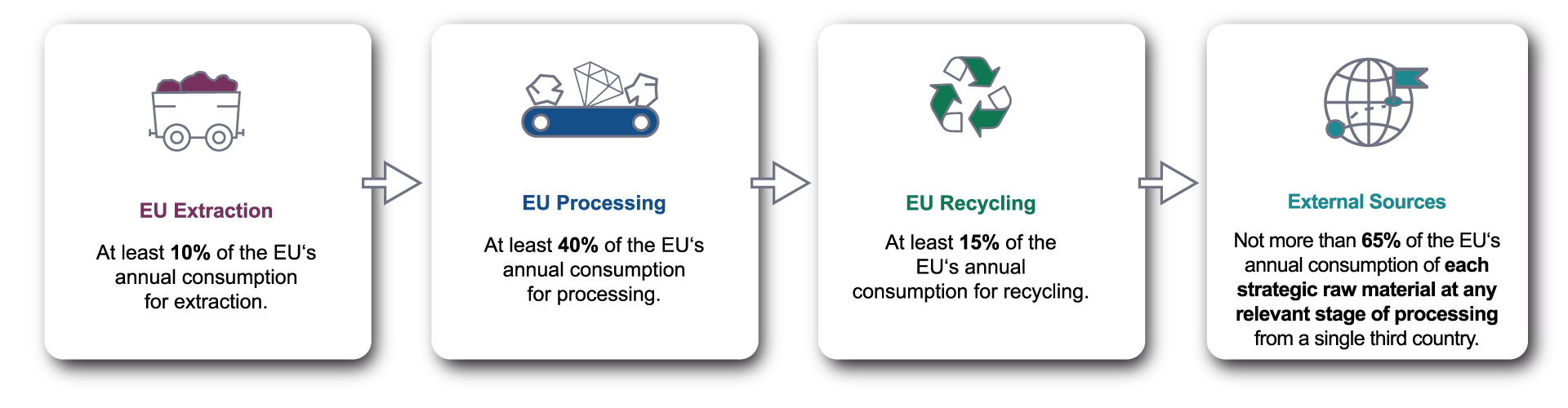

EU benchmarks set by 2030 for domestic capacities