Energy transition and the case for hydrogen

The Intergovernmental Panel on Climate Change (IPCC) released a special scientific report end of 2018 that determines that net-zero emissions by 2050 are necessary for stabilising rising temperature-levels at below 2 degrees Celsius, thereby avoiding the worst and dangerous impacts of a changing climate system.

The energy transition is the most important lever to decrease greenhouse gas (GHG) emissions. Within the space of a few years, the energy transition has become a global phenomenon affecting energy supply structures and the way citizens and companies can contribute to rapid decarbonization. The power sector is leading the way through the transition as solar and wind power increasingly replace coal, natural gas, and nuclear energy as the world’s main energy sources. Read more at Renewables Global Status Report.

Globally, metals will play a central role in successfully building clean technology value chains. Several of these are classed as critical raw materials, and they are now receiving increasing attention.

Electric vehicles, batteries, solar photovoltaic systems, wind turbines, and hydrogen technologies all require significantly more metals than their conventional alternatives to replace fossil fuel needs.

As the energy transition accelerates away from fossil-fuels and towards renewable energy, there will be an unprecedented demand for many metals and materials.

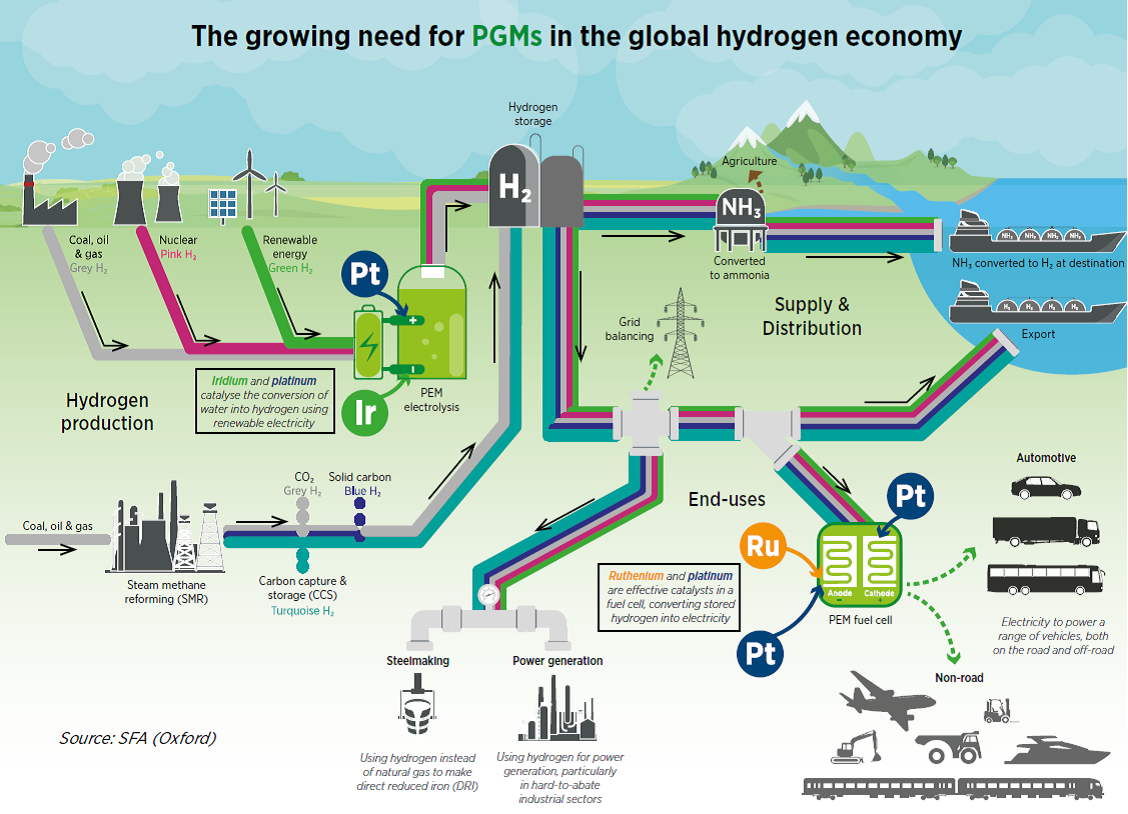

Platinum is one of these critical materials and is essential to the technology that produces clean hydrogen through proton exchange membrane (PEM) electrolysers, and the PEM technology used in fuel cell electric vehicles (FCEVs).

Hydrogen economy

Regulators across the world now recognise how crucial clean hydrogen will be for the energy transition, particularly for sectors that are more difficult to decarbonise such as heavy goods vehicles, steelmaking and other heavy industries, shipping, and aviation. Hydrogen will power these sectors through fuel cells and gas turbines, while also being a feedstock to make other sustainable fuels.

Regulators across the world now recognise how crucial clean hydrogen will be for the energy transition, particularly for sectors that are more difficult to decarbonise such as heavy goods vehicles, steelmaking and other heavy industries, shipping, and aviation. Hydrogen will power these sectors through fuel cells and gas turbines, while also being a feedstock to make other sustainable fuels.

Read more about the essential role of PGMs in the hydrogen value chain in our joint briefing note to the IEA Critical Minerals and Clean Energy Summit.

From the Platinum Group Metals (PGMs), platinum, ruthenium and iridium are needed to enable this fast-growing hydrogen economy.

Iridium is key to water electrolysis, via proton exchange membrane (PEM) electrolysers, to produce green hydrogen.PEM electrolysis is one of the technologies used to produce hydrogen, using iridium and platinum catalysts.Iridium is the metal of choice because of the very harsh/acidic environment which only iridium can handle. Some other hydrogen production technologies also use PGMs.

Platinum is key to both PEM electrolysers and PEM fuel cells used in fuel cell electric vehicles (FCEVs).

Ruthenium plays a part in PEM fuel cells, particularly where the feed hydrogen may be slightly impure. Ruthenium is increasingly of interest in PEM electrolyser catalysts, in combination with Iridium.

PGMs are critical minerals which are essential to hydrogen technology. Therefore, concerns about whether there will be enough metal available to enable scale in these technologies need to be addressed, along with how circularity of PGMs works, the potential cost, and environmental, sustainability and governance (ESG) implications.

Iridium in hydrogen production

Iridium is a by-product of mining for the full suite of the PGMs. For mined iridium supply to be available for future hydrogen applications, it will be vital for substantial markets to continue for the other PGMs to sustain revenues and incentivise investment in future supply.

The annual production of iridium amounts to around 7 to 8 tonnes and is closely related to the mining of platinum (PGMs occur together in the ore body and platinum is the main driver for production; iridium cannot be mined separately), hence, mining of iridium does not happen on its own.

Do we have enough iridium and platinum to scale up hydrogen production?

It has been argued that the scarcity of iridium and its uniqueness in its applications creates an impossible challenge for scaling up PEM electrolysis to the capacities needed. However, this is not true. Research undertaken by industry players suggests that with appropriate management, notably through thrifting and recycling, there will be enough iridium and platinum available to allow PEM electrolysis and PEM fuel cells to scale up to the necessary levels to make a major contribution to the energy transition.

The Hydrogen Council estimates that to reach net-zero emissions by 2030, PEM capacity will need to increase from today’s level of <1 GW to potentially 80-100 GW by 2030 (assuming a 40% PEM market share). In 2021, the amount of iridium required for 1 GW of electrolyser capacity was 400 kg, leading some to argue that the 2030 target would require 32-40 tonnes of iridium. To ensure that electrolyser production can ramp up and the capacity of iridium is enough, iridium must be used much more efficiently by formulating much more efficient catalysts, membranes, and maximising performance, thereby decreasing the amount of iridium required for every GW.

At the same time, the recycling of iridium from the PEM sector must be ensured to become available for reuse in the same application.

Substantial quantities of iridium are currently circulating constantly in closed loops in existing applications, which is generally unseen by the market.

For some applications such as spark plugs, efficient recycling routes have not yet been established, although tonnes of iridium could be made accessible to the market. Here, the legislator (e.g., the EU) could step in to incentivize the recycling of material from scrap.

According to analysts and experts, Platinum, almost uniquely among metals, will see rising demand in new applications naturally replacing declining demand in traditional fossil-fuelled applications, and will be much less subject to a widening supply-demand gap than other metals needed for the energy transition. Concerns that Platinum will act as a barrier to the deployment of hydrogen technologies are misplaced. While the challenges of scaling up clean energy technologies should not be underplayed, Platinum availability presents an opportunity, not a challenge.

Recycling the PGMs from PEM electrolysers will be vital to ensure continued availability of these critical minerals. Collection of end-of-life electrolysers should be relatively straightforward, as these are high-value items located with industrial customers. Most PEM electrolyser manufacturers currently design for a 7-10-year stack operating lifetime.

Find more details in the IPA Whitepaper on Iridium.