Responsible mining and sourcing

PGM Sustainability Assessment Status 2025

PGM Sustainability Assessment Status 2025

Since 2023, the IPA is collecting yearly updates on the status of different auditing and verification schemes of its mining member companies in the context of responsible mining, including but not limited to IRMA – the Initiative for Responsible Mining Assurance, one of the most comprehensive auditing schemes for mining companies.

The status of IRMA certification and self-assessment of our primary producers as well as their general sustainability auditing approaches for 2025 is available here for download.

Reporting standards and principles

All IPA PGM mining companies are publicly listed (London, Johannesburg, New York) companies which routinely report about their environmental, social and governance performance and abide by the regulations set out by national/local authorities and the respective stock exchanges.

IPA members apply sustainability reporting principles to ensure organizations communicate and demonstrate accountability for their environmental, economic, and social impacts, in line with global best practices such as the UN Sustainable Development Goals (UN SDGs), the Global Reporting Initiative (GRI), and the UN Global Compact.

The GRI now also features a sectoral standard on mining. GRI 14: Mining Sector 2024, which addresses the pressing need for consistent, granular, and complete reporting on the sector’s wide-ranging impacts and contributions to sustainable development. It enters into effect for reporting in 2026, with early adoption encouraged.

All members (except Japanese members) are contributing to the Carbon Disclosure Project (CDP) and report according to the standards developed by the International Financial Reporting Standards (IFRS) Foundation. The IFRS Foundation features two standard-setting boards, the International Accounting Standards Board (IASB) and International Sustainability Standards Board (ISSB, founded in 2021).

Six out of 12 members apply the sector specific standards of the Sustainability Accounting Standard Board (SASB, now part of the IFRS Foundation), and 2/3 of members disclose information following recommendations from the Task Force on Climated-Related Financial Disclosures (TCFD) which has now achieved its mission and has been incorporated into the ISBB Standards (IFRS S1 and IFRS S2).

Fabricators (Heraeus, Johnson Matthey, Umicore, Tanaka) have made public commitments to set science-based targets to reduce their Greenhouse Gas Emissions on the road to Net-Zero in alignment with the Science-based Target Initative‘s (SBTi) target-setting criteria.

BASF provided funding to help the SBTi launch a project to derive science-based climate protection targets for the chemical sector, in which they are also involved as a member of an advisory group.

Other guidance

Other guidance like the Johannesburg Stock Exchange (JSE) Sustainability Disclosure Guidance (2022) are currently evolving and only apply to those companies listed on the respective stock exchange. Regulatory authorities are increasingly making sustainability reporting according to outlined criteria mandatory. An example for this is the European Corporate Sustainability Reporting Directive (CSRD) which entered into force in January 2023. This new directive modernises and strengthens the rules concerning the social and environmental information that companies have to report. A broader set of large companies, as well as listed SMEs, will now be required to report on sustainability.

The CSRD aims to ensure that investors and other stakeholders have access to the information they need to assess the impact of companies on people and the environment and for investors to assess financial risks and opportunities arising from climate change and other sustainability issues.

Finally, reporting costs will be reduced for companies over the medium to long term by harmonising the information to be provided. The first companies have to apply the new rules for the first time in the 2024 financial year, for reports published in 2025.

Supply chain due diligence

More and more regulations are being developed which cover supply chain due diligence such as the European Supply Chain Due Diligence Directive or the German LkSG (Lieferkettensorgfaltspflichtengesetz, Act on Corporate Due Diligence Obligations in Supply Chains) which regulates the responsibility of German enterprises to respect human rights in global supply chains.

All these regulations do affect companies that are selling their products into the European market, and are likely to have spill-over effects into other jurisdictions.

The first companies will have to apply the new rules for the first time in the 2024 financial year, for reports published in 2025.

Responsible sourcing standards

The PGM industry adheres to responsible sourcing standards such as:

The London Platinum and Palladium Market (LPPM)

Guidance for refining of platinum and palladium, including the Good Delivery list of acceptable refiners (accreditiation also of ingots and sponges). The LPPM’s Responsible Platinum/Palladium Guidance ensures Good Delivery platinum is conflict-free due to compliance with an audited sourcing process. The guidance has been created to help Good Delivery Refiners and members of the Sponge Accreditation Lists to combat systematic or widespread abuses of human rights, to avoid contributing to conflict, to comply with high standards of Anti-Money Laundering and fighting terrorist financing practice.

The London Bullion Market Association (LBMA)

Responsible Sourcing Guidances for gold, platinum, palladium and silver. The Responsible Platinum and Palladium Guidance (RPPG) has been introduced and is aligned with the existing LBMA Responsible Sourcing Guidance documents. Platinum and Palladium refiners are required to comply with this new guidance since 2019.

Industry spend on SDGs

Mapping industry spend against the Sustainable Development Goals

In September 2015, countries from around the world adopted the United Nations Sustainable Development Goals (SDGs), officially known as "The 2030 Agenda for Sustainable Development" as a universal call to action to end poverty, protect the planet, and ensure that all people enjoy peace and prosperity by 2030. The Agenda is a set of 17 aspirational "Global Goals" with 169 targets between them.

IPA members all pursue their own sustainability strategies and consistently report their progress against the SDGs (integrated reporting).The PGM industry, under the umbrella of the IPA, has undertaken a collaborative effort to map its joint contribution against several SDGs, and to develop a data-supported SDG-narrative in order to present an honest view to society and the growing ethical investor marketplace.

The comprehensiveness of the SDGs cuts across all aspects of business and therefore takes into account how core operations, supply chain, social investment, public advocacy, policy dialogue and partnerships contribute in positive or negative ways to the SDGs.

The SDGs cover exceptionally well the multiple aspects which are asked of modern business - their impact on society, on the environment, and their financial wellbeing.

The Report 2021 "Platinum Group Metals for a Sustainable World - SDG Mapping" can be downloaded here.

Sustainability Assurance Frameworks

The PGM industry is strongly committed to the principles of responsible mining and sourcing with the aim to communicate transparently on the status of sustainability assurance of our members. The role of IPA is to facilitate good practice exchange, collaboration, and engagement in response to challenges, as well as managing risks and creating value along the PGM supply chain for all relevant stakeholders. IPA is standard-agnostic hence not imposing a specific standard on mining companies. However, existing audit schemes have been evaluated by the IPA Sustainability Committee regarding scope, recognised quality management standards as well as accepted audit practices.

Based on this evaluation, the mining members of the IPA have committed to be independently audited either against the Initiative of Responsible Mining Assurance’s ‘Standard for Responsible Mining’ (IRMA) or against the Together for Sustainability (TfS) audit with enhanced mining protocol (eTfS).

Some of the IPA members are also ICMM members and have conducted their self-assessments against ICMM Performance Expectations. ICMM's Mining Principles define the good practice environmental, social and governance requirements of company members through a comprehensive set of 39 Performance Expectations and 9 related position statements on a number of critical industry challenges.

IPA is also monitoring and engaging with the Consolidated Minining Standard Initiative (CMSI), the collaborative effort of four well-established standards – The Copper Mark, Mining Association of Canada’s Towards Sustainable Mining (TSM), World Gold Council’s Responsible Gold Mining Principles and ICMM’s Mining Principles – to create one, global standard that reduces complexity and clarifies responsible practices for mining companies of all sizes, across all locations and commodities. The CMSI is not yet finalized; IPA will assess the inclusion of CMSI to its list of recommended standards once it is operational.

Together for Sustainability (TfS) is actively raising CSR standards throughout the chemical industry. Members are chemical companies committed to making sustainability improvements within their own – and their suppliers’ – operations.

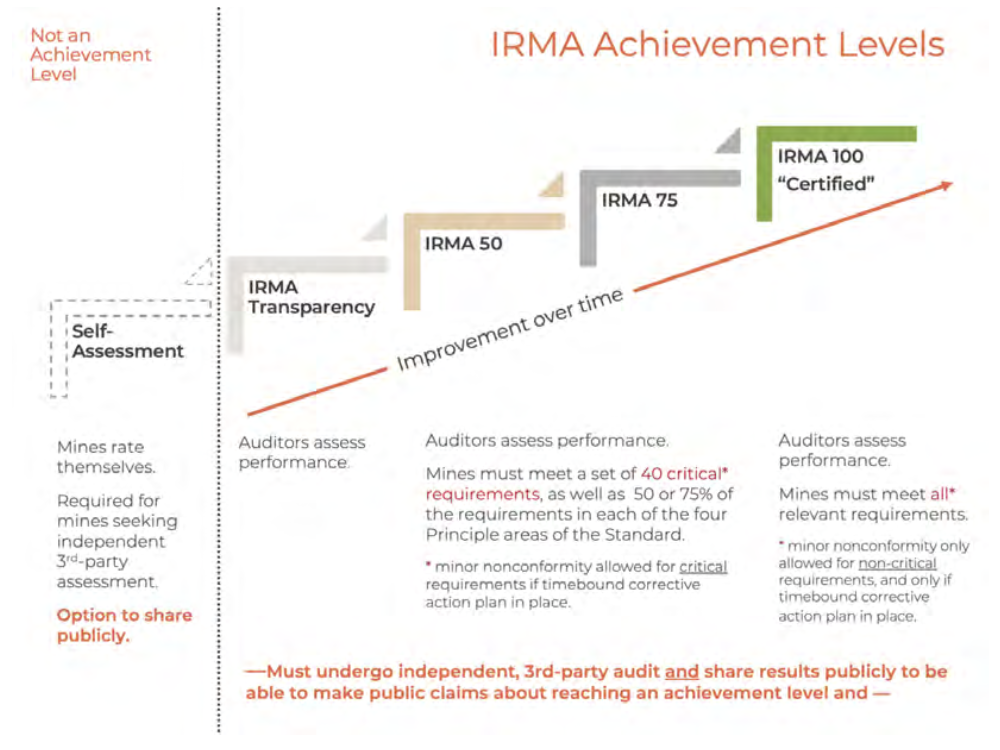

IRMA’s Standard for Responsible Mining has been developed over ten years through a public consultation process with more than 100 different individuals and organisations, including mining companies, customers and the ultimate downstream users of mined products, NGOs, labour unions, and communities. IRMA’s approach to responsible mining is to assess social and environmental performance at mine sites globally using an internationally recognized standard that has been developed in consultation with a wide range of stakeholders and is based on multi-stakeholder leadership. Audits are made publicly available.

A best practice example for a PGM IRMA Audit can be found in Valterra's Mogalakwena mine IRMA Case Study.